Pivotal April tax collections beat expectations by more than $1 billion in Massachusetts, but the strong month for revenues does not mean the state now has an extra $1 billion to balance the fiscal year 2024 budget.

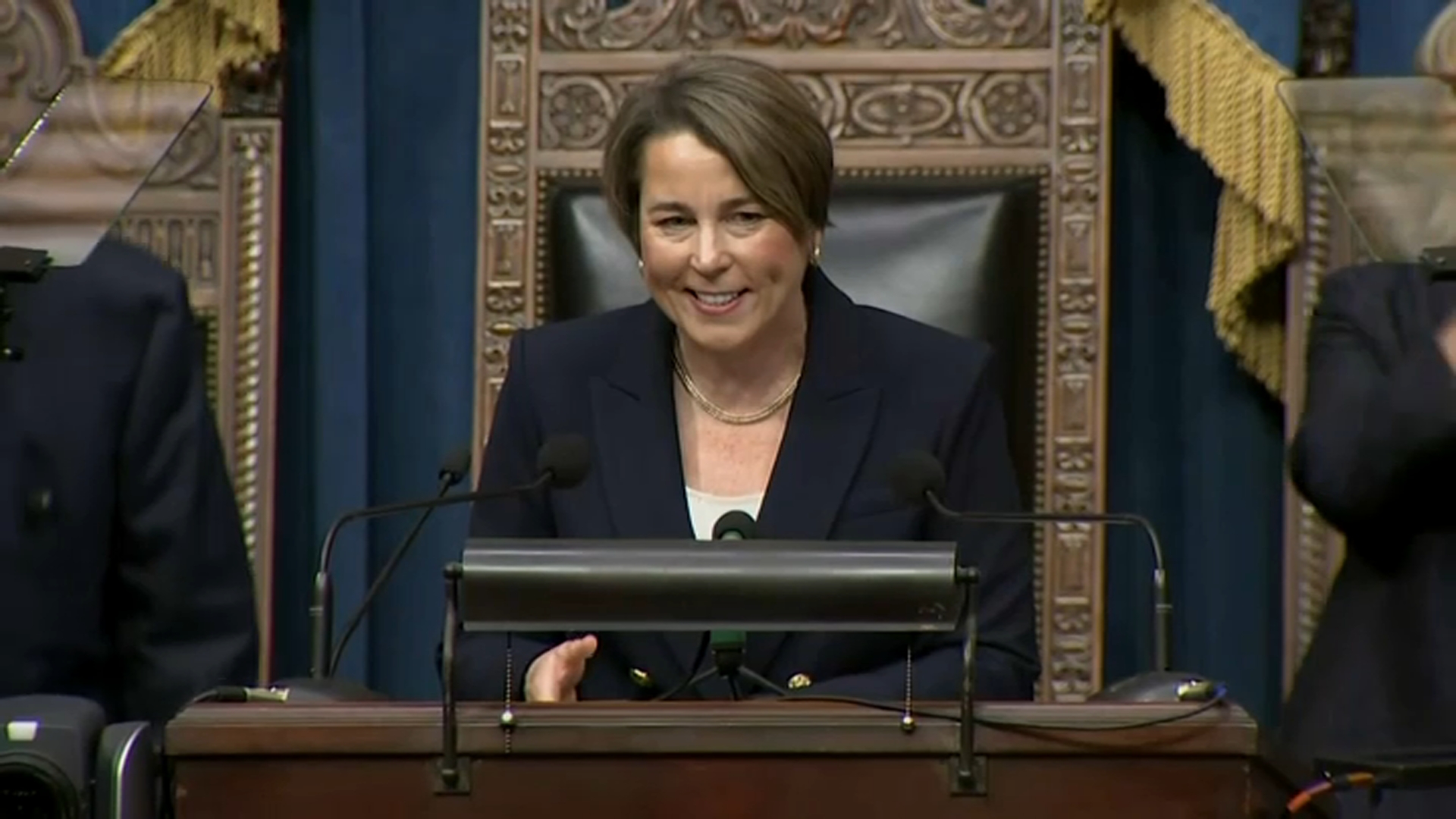

Collections of $6.324 billion last month exceeded the Healey administration's monthly benchmark of $5.291 billion by $1.034 billion or 19.5 %. But officials said much of that overage came in the form of capital gains tax revenue and income surtax revenue, money that is to be set aside for specifically mandated purposes. That money is not available to support general budgeted spending but it could eventually help the state sock away more savings or invest in transportation and education.

Heading into April, state tax collections for fiscal 2024 were trailing expectations by $145 million. After the new revenue report, the state's tax take is ahead of projections by $889 million but administration officials acknowledged that the spread between budgeted spending and general-purpose tax revenue that can be used to support that spending is significantly less.

Administration and Finance Secretary Matthew Gorzkowicz said Friday afternoon that almost all of April's over-benchmark performance came in the non-withheld income category, which he said is a signal that it stems from the income surtax on high earners or capital gains taxes. He said the Department of Revenue will need to do additional analysis to determine exactly how much of the month's haul came from surtax and capital gains revenues.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

But Gorzkowicz said he thinks the state budget will be in good position to end fiscal year 2024 in balance come the end of June, and he said the Healey administration is not planning to take any additional budget actions (including rolling back savings initiatives already implemented) as a result of April collections.

Revenue collected from the state's new surtax on household income above $1 million can only be used to support education and transportation investments, and any amount that comes in above DOR's projection of $1 billion for the year is automatically diverted to two new education and transportation trust funds.

More Mass. politics

State law also requires that any capital gains tax revenue above a certain threshold (set at $1.48 billion for fiscal 2024, a threshold that Gorzkowicz said Friday the state has already hit for the year) be automatically transferred into the Stabilization Fund and other reserve accounts.

A handful of major tax categories underperformed their benchmarks in April, including income withholding, sales tax, and corporate and business taxes. Gorzkowicz highlighted those categories Friday afternoon as he pointed to the potential for additional budget risks in May and June, which trails only April in terms of tax collection importance.

Through April, the 10th and single largest month of the budget year, DOR has collected $33.857 billion. That's $1.537 or 4.8% more than actual collections in the same 10-month period of fiscal 2023, and $889 million or 2.7% more than what the Healey administration projected that it would have hauled in by this point in the calendar when it made mid-year revenue and spending adjustments.

There are two months left in fiscal 2024. DOR is due to report on May collections by Weds., June 5. The administration's monthly benchmark for May is set at $2.639 billion, which would be $68 million less than what was collected in May 2023. That will be the final temperature-check on tax collections until fiscal 2025 starts on July 1. DOR has no specific deadline for reporting June revenues, which often accompany a report on full-year collections.

Get updates on what's happening in Boston to your inbox. Sign up for our News Headlines newsletter.