You probably get fake texts and emails every day — scammers mimic real companies to trick you into divulging your personal information.

A Boston woman mistakenly fell for one of these scams in July when she got a text message she thought came from her bank.

WATCH ANYTIME FOR FREE

Stream NBC10 Boston news for free, 24/7, wherever you are. |

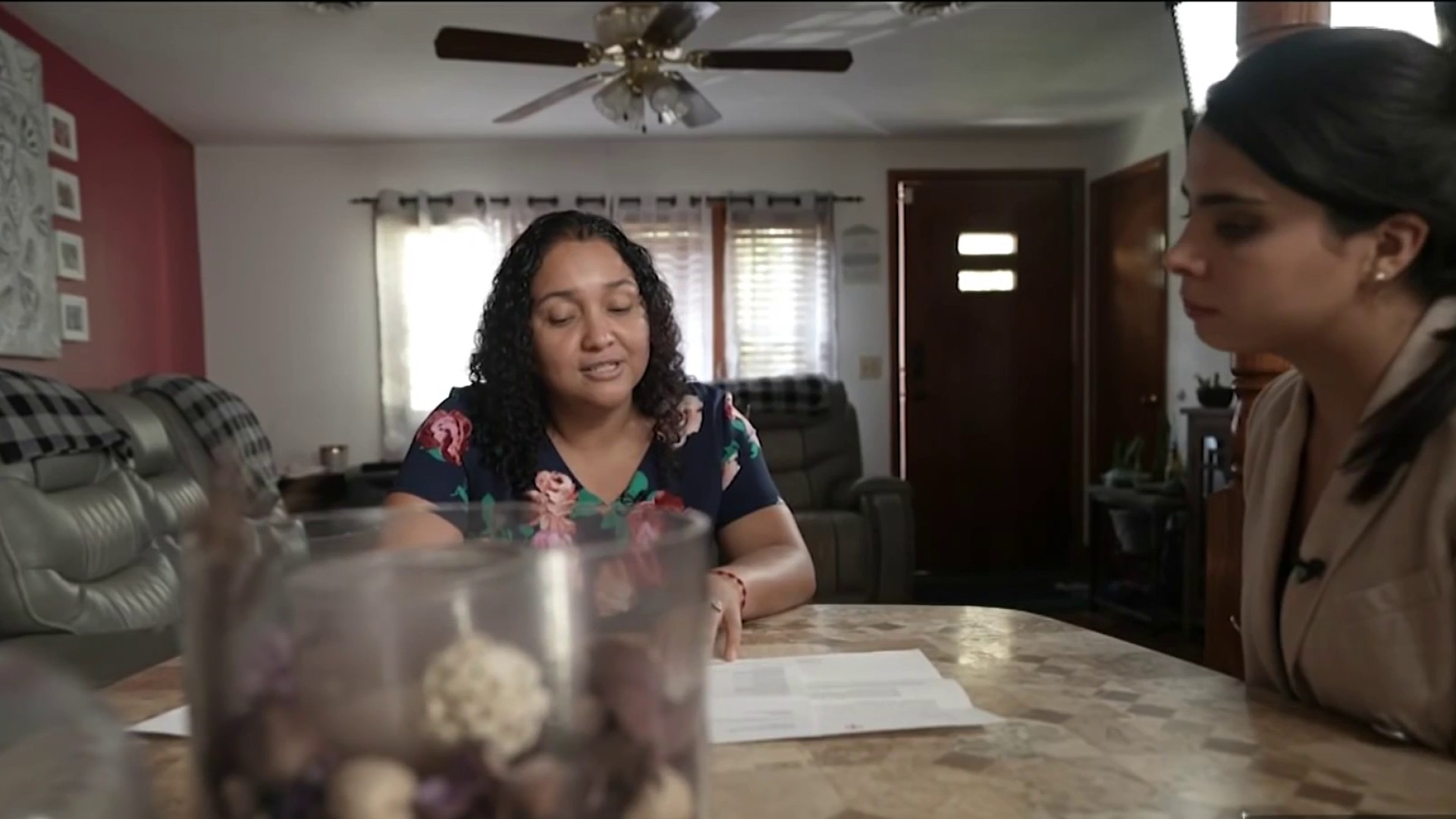

"It said it was from Chase … it said that, like, my account got compromised," said Sarah Valmond of West Roxbury. "They said I need to change my PIN code, and I was like, 'Oh, wow.' And they gave me, like, 'Oh, you have this much time or your card is going to, like, we're going to have to send you out a new card, like, your card is not going to work anymore.'"

She said the text looked legitimate, and she clicked on a link in it and provided scammers with her bank card and PIN.

Get updates on what's happening in Boston to your inbox. Sign up for our News Headlines newsletter.

Days later, she says she was ordering groceries online when her card was declined and she realized her bank account was empty.

On July 6, someone made three ATM withdrawals in Westwood, and a $4,000 in-person withdrawal at Chase Bank in Dedham, draining her account of $5,200.

"I was freaking out. I'm like, 'This is, like, this is lagging. Something's wrong,' like, I could not believe it. I really thought it was just, like a joke," said Valmond. "It was my nightmare. Honestly, honestly, like working, saving … I had school supplies and clothes and everything to get ready for, and all of it's gone."

Valmond filed a fraud claim, and Chase initially credited her account. But the bank reversed course a week later, telling her, "we found that the transaction(s) was processed according to the information you provided or was authorized."

"I called, like, probably four times after … I even stayed on the phone for almost two hours waiting for a supervisor once, like, they don't let me speak to no one," said Valmond. "They just like, 'Hey, this is it, we said what we said, and that's all.'"

Valmond says she accepts responsibility for giving out her banking information, but she thinks Chase should have done more to protect her account.

She says she did not receive any security alerts about the withdrawals and wonders how someone was able to tap into her account when she had her debit card in her possession.

"These people are finding out different ways to take people's money, and to, like, use your system," said Valmond. "The higher-ups need to get together and find out ways to, like, encrypt things better, because you are just basically showing that these people are smarter than you. These are large companies, people trusting you with thousands of dollars, and you are just letting them take people's money that they work hard for."

NBC10 Boston Responds contacted Chase on Valmond's behalf, asking how the withdrawals were made without her physical bank card.

Five days later, a Chase spokesperson let us know the bank had approved her claim and put the $5,200 back into her account.

More from NBC10 Boston Responds

Chase declined to comment on her case, but issued some tips on how to protect yourself against scams.

Never share your banking password, one-time passcode or send money to someone who tells you that doing so will prevent fraud on your account. If you want to be sure that you are speaking to a real bank employee, call the number on the back of your debit or credit card or visit your local branch.

If you believe that you may have been a victim of fraud or scam, report it immediately to your bank, credit card issuer or local law enforcement agency.

And make sure you set up security alerts on your bank accounts.

If you have a consumer problem you need help with, reach out to NBC10 Boston Responds here.