Across Massachusetts, we’ve seen an endless collage of abandoned holes in the ground, unfinished projects, and expensive homeowner headaches since launching our “To Catch a Contractor” investigative series.

During that statewide tour, a common theme has emerged. Upon losing thousands of dollars, consumers often attempted to report their situations to local law enforcement.

WATCH ANYTIME FOR FREE

>Stream NBC10 Boston news for free, 24/7, wherever you are. |

“It’s a civil matter,” was the response homeowners told us they received the majority of the time.

Those exchanges were recounted again and again during our interviews with customers of a pool contractor who left a wake of unfinished projects; a paver eventually convicted of taking deposits and never doing the job; a contractor who became the focus of a private social media group; and a nurse practitioner moonlighting on home improvement projects.

Get updates on what's happening in Boston to your inbox. Sign up for our >News Headlines newsletter.

To people who lose thousands of dollars in hard-earned savings, the experience can certainly feel like a crime.

So why is it that authorities often don’t view the scenarios as criminal matters?

In Massachusetts, the way the statute is written, prosecutors have to prove a contractor never intended to finish a project.

More from the 'To Catch a Contractor' series

Accepting a deposit and disappearing can be an open-and-shut larceny case. However, the legal hurdle is trickier once a shovel digs into the ground or a hammer hits a nail.

“How do you get into somebody’s head? How do you prove that was actually their intent at the time of the receipt of the money?” said Plymouth County District Attorney Timothy Cruz. “That’s a challenge.”

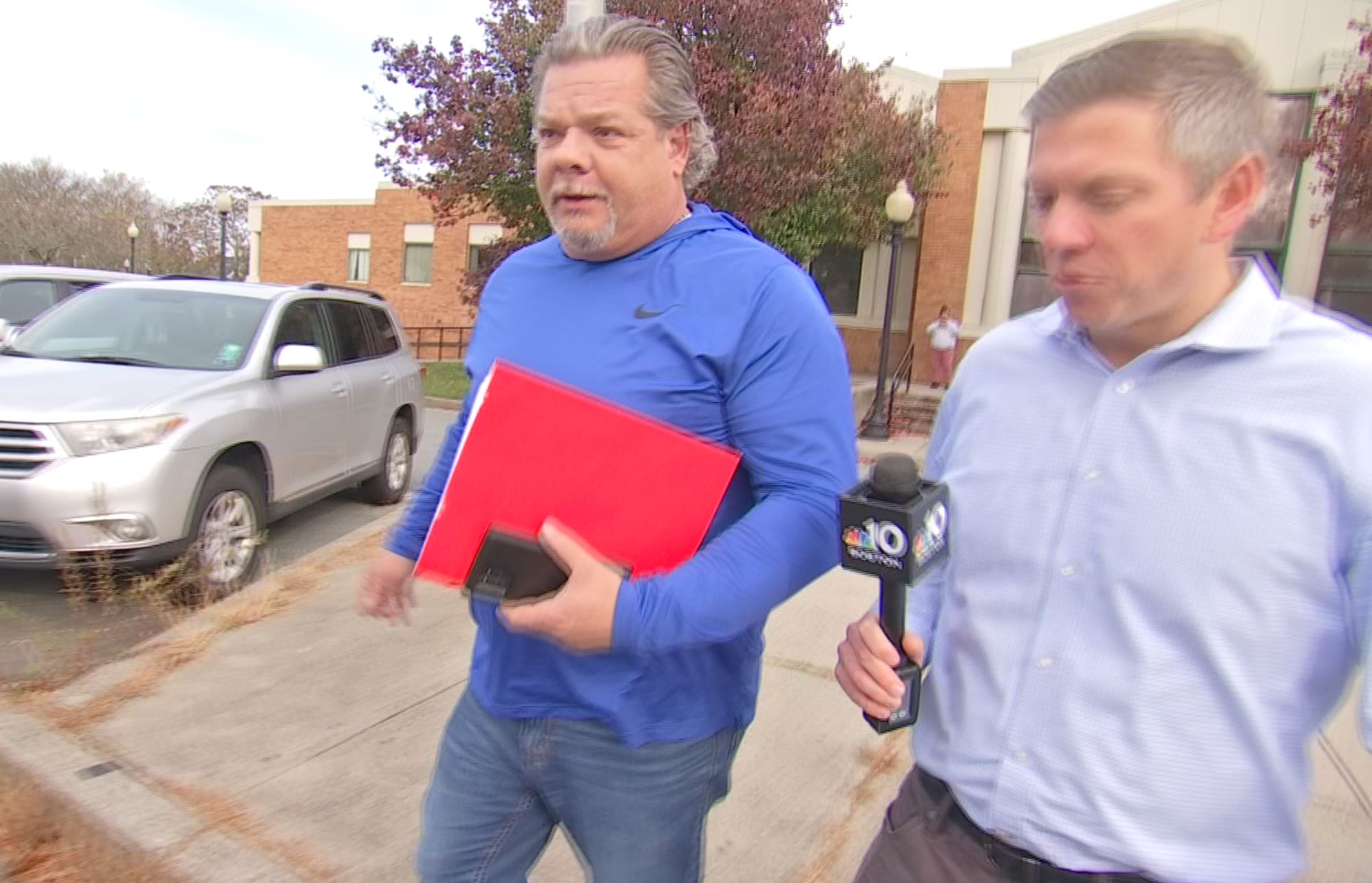

It’s a challenge Cruz’s office will be taking on with pool contractor Steven Docchio.

After our investigation detailed a path of destruction across Massachusetts, a grand jury indicted Docchio last year with a long list of criminal indictments.

The contractor is currently out on bail and awaiting trial. At his arraignment last July — which featured a number of animated moments in the courtroom — Docchio told the judge the case did not belong in criminal court.

“These are contractual, civil things,” he said.

Have a tip for the NBC10 Investigators? Email us at tips@nbcboston.com.

We took the issue to NBC10 legal analyst, Michael Coyne, who is dean at the Massachusetts School of Law.

“Your series has revealed how widespread this problem is,” Coyne said. “To me, it’s fixable with a different statute. If you have to prove the person’s intent to defraud at the time they took the deposit, that is almost a nonstarter in all these cases.”

Indeed, numbers we obtained from the Massachusetts Trial Court paint a bleak picture. The charge most often associated with home improvement projects gone wrong is “larceny by false pretense.”

Since 2020, figures show there have been 939 cases filed with a larceny by false pretense charge.

Over that same time period, only 166 cases have been disposed with a larceny by false pretense charge. That’s a rate of less than 20% (note: more recent cases are likely still pending in court).

Coyne said instead of trying to change the existing larceny by false pretense language, there should be a new “home repair fraud” statute implemented.

“Change the statute. Don’t make it a question of intent,” Coyne said. “Do the facts indicate that the consumer’s money was in essence stolen from them? And if it was, then the criminal courts should be of much more assistance in trying to bring recovery in these cases.”

Some of our reporting for this series has already prompted results on Beacon Hill, including proposals for stronger background checks, and raising the cap on a state fund that helps homeowners recoup money if they get ripped off by registered contractors.

Homeowners we spoke with repeatedly said they hope lawmakers take a closer look at whether the current statute adequately protects consumers.

“It’s unfortunate we don’t have stronger laws in Massachusetts that can stop some of this from happening,” said Kate Merritt-O’Toole, a Framingham homeowner who organized a group of victims that lost money to the owner of a paving business.

“Someone has robbed me,” said Rose Khnaizir, a Stoughton homeowner who lost $25,000 on a failed pool project. “And the law is not there to protect me.”