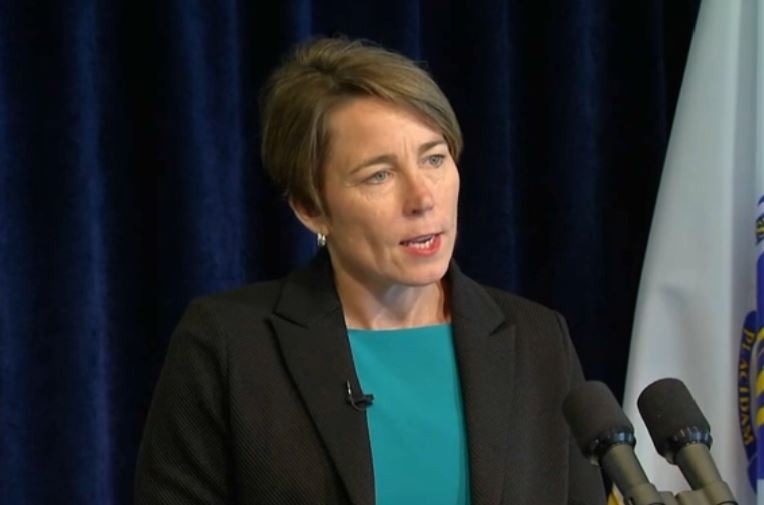

Massachusetts Gov. Maura Healey and Lt. Gov. Kim Driscoll unveiled on Monday a proposal for a $742 million tax relief package, one that the governor's office said would provide "significant savings" for many taxpayers in the Commonwealth, including families and seniors.

The proposal was announced Monday morning during a news conference at the Demakes Family YMCA in Lynn. The plan would impact families, seniors, renters, farmers, commuters and more, the governor's office said.

WATCH ANYTIME FOR FREE

>Stream NBC10 Boston news for free, 24/7, wherever you are. |

The proposal for Fiscal Year 2024 tax reforms will be filed on Wednesday as a piece of companion legislation to the budget proposal. The tax relief package comes amid a rising cost of living, and in response to what Gov. Healey described as Massachusetts being outpaced by other states in terms of affordability.

Get updates on what's happening in Boston to your inbox. Sign up for our >News Headlines newsletter.

Healey said the tax measures were based in part on conversations she and Lt. Gov. Kim Driscoll had while traveling around the state.

“I hear from people who are struggling to get by as the cost of living continues to skyrocket past them — the family watching their grocery bill grow each week, the young mom who wants to return to her dream job but can’t afford child care, the recent college graduate who can’t afford both his rent and student loan payments,” Healey said.

Phineas Baxandall is policy director for the Massachusetts Budget and Policy Center, also known as MassBudget. The organization sent a letter to the then-incoming Healey administration in December expressing support for their proposed family tax credit.

"$600 per child or adult dependent at home can go a long way and mean a difference between what kinds of presents you're able to have Christmas, whether you're able to spend a little bit of extra money to have healthy food on the table. It really makes a difference directly for the family. But it also makes a difference for the businesses in the community. Because people have money that they can spend and then those local businesses enjoy that support as well," said Baxandall.

"This is definitely a good step for small businesses, especially when it comes to the estate tax," said Christopher Carlozzi, National Federation of Independent Business Massachusetts. "In Massachusetts, we were a major outlier. We were the lowest exemption in the nation. And this starts to make us a little more competitive with this tax. The only problem is that we are one of the few states that actually has this tax. So it's a step in the right direction, but we'd like to see this tax go away altogether."

"For a first small business when a business owner passes away, it just makes it easier to hand the business over to the family, and it makes it less of a disruption especially for the employees that worked for the business. You don't want to see that sort of disruption," added Carlozzi. "And a lot of times in a small business, most of the money when there's a sale of a business, it's tied up in things like land, like assets, like equipment, so often at the time of an owner's death, that money is not available to pay that tax. So this makes it a little more equitable for smaller businesses of all types of businesses, whether you're talking about a retail shop, or a some sort of manufacturer, or even a farm as farms fall into this, and it's something that's particularly onerous for them."

"It has a long term cost of roughly nearly a million dollars a year. That's a pretty significant permanent tax change to the tax system," said Evan Horowitz, executive director at the Center for State Policy Analysis at Tufts University. "And in my assessment is probably a little bit bigger than we could easily afford. So I expect some paring back of the size of it. It also has a reissue some elements that the legislature rejected last time, so I'd be surprised if they wanted to pick them up. Now that includes the capital gains tax cut. So I think there'll be some haggling over that."

While Healey said her goal is to put money back in the pockets of people who need it most, Horowitz says the credits won't be accessible to everyone.

"One challenge, for instance, with the tax credit for renters, it's nice to give people rent a larger tax credit. However, it's not available to those who don't pay a sufficient amount of income taxes. So a large number of people in the state are exempt from paying income tax don't earn enough or they don't pay enough to get this full credit," Horowitz said. And so even though the size is being increased, not everyone will be able to take advantage of it, and particularly those who need it most won't be able to take advantage of it. So it lacks this key characteristic that we call refundability. It doesn't have that, and that's a real problem."

Here are some highlights to the proposal.

Healey’s proposal includes a new tax credit that would provide families with a $600 credit per dependent, including children under 13, people with disabilities, and senior dependents ages 65 and older. The tax credit would cost the state about $458 million and help about 700,000 taxpayers.

The measures would also increase the state’s rental deduction — currently limited to 50% of rent up to $3,000 — to $4,000. The change would cost the state about $40 million, while helping offset housing costs for 880,000 renters, she said.

The administration is also proposing doubling the senior circuit breaker credit from $1,200 to $2,400 for low-income seniors with high property taxes or rent, which would help about 100,000 seniors stay in their homes.

The proposal now heads to the Massachusetts House and Senate. Both chambers are controlled by Democrats who will likely make changes before arriving at a single compromise version to send back to Healey.

Healey’s bill would also reduce the short-term capital gains tax from 12% to 5%. Wisconsin and South Carolina are currently the only other states that tax short-term capital gains at a higher rate than long-term capital gains, according to the administration.

The proposal would also eliminate the estate tax for all estates valued at up to $3 million with a credit of up to $182,000. Massachusetts is one of only 12 states that has an estate tax and shares the lowest threshold of those twelve with Oregon, according to Healey. It would reduce the tax burden on smaller estates.

Other elements in the bill are aimed at benefiting dairy farms, encouraging live theater productions, promoting locally produced hard cider, and aiding student borrowers and bicycle commuters.

Affordability was a big issue for Healey during her campaign.

“Our job from day 1 is to make our state more affordable," Healey said back in November during her victory speech. "I’ll be a governor for every person who is struggling with higher costs. We’ll make Massachusetts more competitive so that the people who come here, stay here and grow their businesses here."

"There is much to support in this tax package, and it certainly represents a good first signal that the administration will work with the business community, especially with the inclusion of capital gains and estate taxes," James E. Rooney, president and CEO of the Greater Boston Chamber of Commerce, said in a statement. "However, there remains much work to do to restore Massachusetts' competitiveness to keep residents and businesses here, and we look forward to working with the legislature on this tax package and the budget in the coming months. With a state budget that increased by $10 billion — 25% — in just four fiscal years because of private sector wage growth, policymakers must find meaningful ways to continue to support the region's employers as they seek to stay and succeed here."

A presentation by the Greater Boston Chamber of Commerce and the Massachusetts Society of CPAs found the Greater Boston Metro area lost 35,000 people from July 2020 through July 2021.

"The tax environment is going to continue that if we don't take steps to mitigate both people leaving but also decisions made by businesses both in terms of starting up a new business or large companies that make location decisions on where to put a factory or where to put a research lab," Rooney said.

The report supported several tax relief measures that are included in the Healey administration's proposal, including increasing the estate tax threshold, reducing the short term capital gains tax rate and increasing the rental deduction.