As Massachusetts waits to learn the fates of Steward Health Care hospitals here, the bankrupt company has "entered into a definitive agreement" to sell its physicians network to a subsidiary of a New York-based private equity firm for $245 million in cash, Steward announced late Monday night.

Rural Healthcare Group, headquartered in Tennessee and an affiliate of Kinderhook Industries, will buy Stewardship Health pending U.S. Bankruptcy Court and regulatory approvals, the company said. Steward said its doctor network "will continue to serve its loyal patient following in the Commonwealth of Massachusetts under new ownership" and officials from Rural Healthcare Group said they are experts in transitioning clinics to independence. Steward is expected to seek approval of the transaction at a Bankruptcy Court hearing Friday.

WATCH ANYTIME FOR FREE

>Stream NBC10 Boston news for free, 24/7, wherever you are. |

"Kinderhook has over 20 years of experience investing in mid-sized health care businesses that serve the nations’ most vulnerable populations. Kinderhook’s investments are focused on protecting access to high-quality healthcare in communities that are truly underserved. Rural Healthcare Group is a well-respected group of healthcare professionals that specifically focuses on underserved and underinsured areas," Steward President Mark Rich said in a statement. "We are confident that Stewardship Health will continue its stellar treatment of the patient population as a result of this transaction."

Stewardship Health is "among the largest Medicare accountable care organizations in the United States" and serves more than 800,000 patients annually with about 3,250 affiliate providers. Stewardship Health employs more than 290 physicians, the company said.

Get updates on what's happening in Boston to your inbox. Sign up for our >News Headlines newsletter.

Rural Healthcare Group CEO Benson Sloan said his company is "excited to bring our mission and approach to the state of Massachusetts, and the other states where Stewardship operates and supports primary care clinics." The company signaled plans to "preserve and expand high-quality care" and Sloan said RHG would make "significant investments in Stewardship’s infrastructure, which will allow providers to continue seeing patients in existing clinics across the Stewardship network."

"In many ways, RHG has directly preserved and restored primary care in our Tennessee and North Carolina markets as both independent providers and health systems have sought us out to ensure long-term continuity of care in their communities. A thriving primary care infrastructure is critical to supporting local hospitals and specialists, as primary care providers are instrumental in ensuring patients are directed to the appropriate facilities at the right time," Sloan said.

The company noted that its purchase of Stewardship Health will disconnect the physicians network from Steward's hospital network and said "transitioning clinics from health system-owned to independent is an area of expertise for RHG, and ultimately a benefit to patients."

Late Sunday night, Steward said it was delaying the sales hearing for Stewardship Health and hospitals in Massachusetts, Arkansas and Louisiana from Tuesday afternoon to Friday morning.

Sign up for our Breaking newsletter to get the most urgent news stories in your inbox.

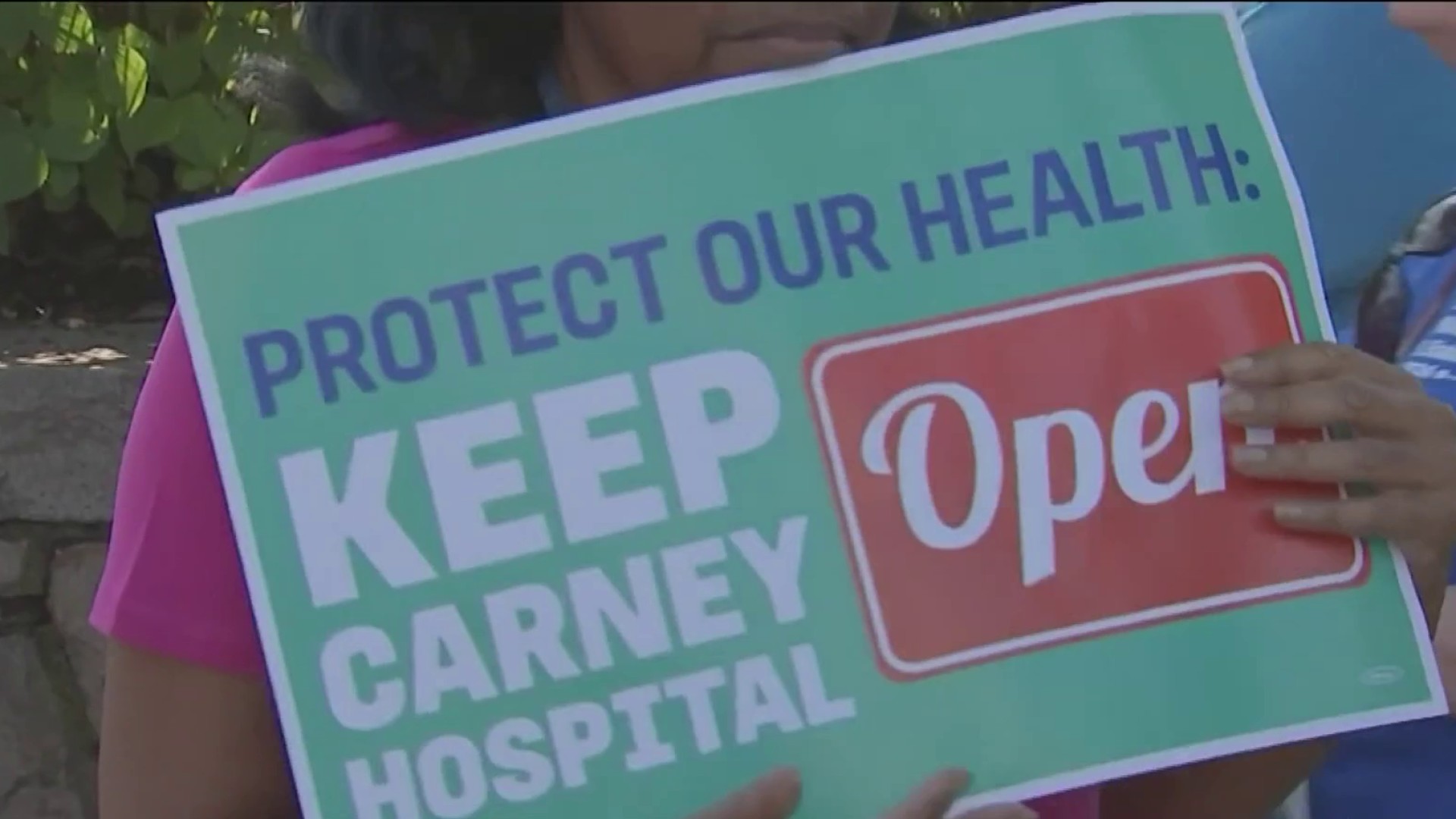

The company has already received court approval to close Carney Hospital in Dorchester and Nashoba Valley Medical Center in Ayer, but company officials have told the court that they "received binding bids from local operators to acquire six (6) of their Massachusetts hospitals which includes Saint Elizabeth’s Medical Center, Saint Anne’s Hospital, Good Samaritan Medical Center, Holy Family Hospital – Haverhill, Holy Family Hospital – Methuen, and Morton Hospital."

Toby King, a senior managing director in investment banking at Leerink Partners who helped lead the Stewardship sale process, said in a court filing that the sale to Rural Healthcare Group "represents the highest and best transaction for Stewardship Health."

King said Leerink Partners contacted 40 potential purchasers, about half of which signed confidentiality agreements to get more information and 10 ultimately participated in a presentation led by Steward's management team and got an opportunity to engage in additional discussions with Steward management. Four potential buyers submitted non-binding indications of interest, including United Healthcare's Optum.

After Steward filed for bankruptcy on May 6 and Optum walked away from its deal for Stewardship Health, Leerink went back out and contacted an additional 17 potential buyers, King said.

Ultimately, there were two binding bids for the doctors network. One was Rural Healthcare Group's bid -- put in under the name "Brady Health Buyer LLC" -- that had an initial "headline value of between $175 – 215 million." The other was a $225 million credit bid from Steward's "first in, last out," or FILO, lenders.

With those two bids in hand, King said, Steward "continued to engage with the bidders in effort to improve the terms of each bid" ahead of an auction. Both sides submitted revised bids with heightened terms.

"In advance of the auction, due to, among other things, the prospect of the FILO Lenders’ credit bid, Brady improved its bid, and proposed a purchase price of $245 million. As a result of the Brady’s improved terms, the FILO Lenders determined that such purchase price was more than they were willing to credit bid and informed the Debtors that they would not match or exceed the Brady Bid," King wrote in his filing. "Given the competitive bidding process significantly improved the terms of the Brady Bid such that the FILO Lenders were not interested in submitting a higher or better bid, the Debtors worked to finalize the transaction documentation for the Sale Transaction with Brady."

More on Steward Health Care

Also Monday, the U.S. Department of Justice filed an objection related to Steward's plan to seek court approval to sell Stewardship Health and a number of its hospitals (including as many as five in Massachusetts) at a hearing this Friday.

The federal government "objects to any Proposed Sales to the extent such sales seek to transfer the Debtors’ Medicare Part A Provider Agreements in violation of applicable federal law," the filing said. The DOJ suggested that it filed the objection and reservation of its rights in part because Steward has not yet disclosed the identities of the companies bidding on hospitals that it expects to sell by the end of the week.

"Under the Bid Procedures Order … the Debtors should have disclosed the results of the auctions, including the Successful Bidders and material terms for the Proposed Sales, on August 7, 2024. As of this filing, the Debtors have not disclosed the Successful Bidders for the Proposed Sales, or filed proposed orders or asset purchase agreements indicating the terms of such Proposed Sales pursuant to the Bid Procedures Order," DOJ wrote. "The Debtors have indicated, however, that despite their lack of disclosures they intend to seek approval of the Proposed Sales at the Sale Hearing."